ARB Corporation - Deep Dive

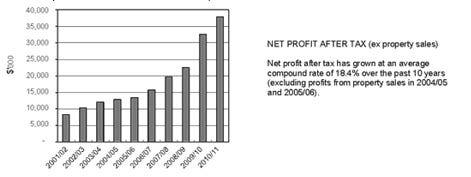

ARB listed in 1987 and has compounded EBIT at 25% delivering one of the highest compounded returns on the ASX.

Business Summary

ARB is a designer, manufacturer, and retailer of branded 4x4 accessories. They sell a range of Fabricated Metal, Mechanical, Suspension, Canopies and Traded products. This range is rapidly expanded every year with ~2% of revenue spent on R&D every year. These products are mainly sold through the well renowned ARB brand which commands a premium price to competitors. The consistency and focus of ARB over 45yrs has led to an estimated market share in Australia of between 40%-50% across the entire range of 4x4 accessories (excluding wheels and tyres). The ARB brand is very strong as it represents quality and reliability two timeless requirements for these products.

ARB Competitive Advantage

1- Product Development: ARB have a team of 100+ engineers that work directly with the engineering teams of OEMs to make accessories that are in some cases are certified by the OEM themselves as they are at such a high standard. This scale and depth of product expertise and know-how has allowed an integration with OEMs to the level that when new models are released ARB have a full suite of product available day 1 of launch, sometimes this is up to 100 items. This positions ARB years ahead of competitors. The second element of competitive advantage from product development lies in the ability to in-house product manufacturing, The best case study of this in ARBs history has been the Ascent Canopies product, ARB were reselling a range of canopies up until 1998, at that point they became unhappy with the quality and reliability of the supplier so they launched the Ascent Canopy, they grew market share from 5% to over 20% of canopies within 5years.

2- Brand: ARB have a 45year heritage that has an identity with deep roots, its represents the vast open outback of Australia, a world renowned rugged and tough environment, ARB are made for these conditions and were born out of it. The quality and reliability of superior engineering and only the highest quality materials have protected its customers for 45years and that dependability and image of adventure are now why people pay an almost 35% premium for ARB products. This brand loyalty creates a certain resilience in the business and is only replicable with the passing of time. Many cheaper alternatives have attempted to displace ARB, in 1992 ARB faced competition from cheaper Chinese replica imported suspension products, which ultimately failed but illustrate the resilience of the ARB brand.

3- Distribution: due to the significant scale of stores, distribution partners and dealers ARB commands a market share far greater than any competitor and results in the cost and revenue scale advantages. As an example ARB can acquire distribution rights at a higher price than any other bidder as they can deliver a selling network of 100+ outlets & 75 store network, this has strengthened over the 35 years and began with their foundational acquisition of the Air Locker and Old Man Emu acquisitions which are both possibly $100M product lines and were acquired for $2.5M and $200k respectively. ARB distribution has become much more extensive in the past 10years and this has resulted in an acceleration of capital deployed on acquisitions.

ARB has compounded revenue at 19% since 1987 and over the past 10years they have compounded revenue at 10%. ARB has compounded EBIT at 25% since 1987 and 13% over the past 10yrs.

ARB History

1975 – ARB founded by Anthony Ronald Brown (ARB) in a home Garage and shortly a 1000sqft factory in Ringwood after returning from 4x4 trip in northern territory and failing to find reliable protective gear for his vehicle.

The first 2 products were the ARB bull bar and the ARB roof rack.

1976 – ARB Engineering Pty Ltd was formed, this would be the eventually entity that is corporatized

1981 – ARB outgrows Ringwood facility and moves to a factory double the size.

1983 – ARB stores established in every Australian state.

1985 – ARB releases the Air Locker product in Australia and the USA

1987 – ARB is publicly listed on the ASX at 5.6c or $5M market cap making a profit of $100k per annum (pre-tax).

1988 – ARB acquires Old Man Emu suspension for ~$300k of goodwill + Assets.

1991 – ARB USA established in Seattle

1998 – ARB launches a range of Ute Canopies

2000 – ARB Sahara bar is released

2004 – ARB sells 100,000 air lockers

2006 – ARB products sold in over 100 countries worldwide, ARB establishes a manufacturing plant in Thailand.

2008 – ARB releases its own brand car fridge

2012 – Intensity range of driving lights released

2014 – ARB Europe established in Prague Czech Republic.

2014 – 50th ARB store opens in Australia

2015 – ARB expands to manufacture Alloy bull bars, The ultimate 4x4 shock absorber BP-51 is released into the market, ARB celebrates 40th anniversary.

2016 – ARB middle east is established in Dubai UAE

2017 – ARB launches new flagship store program, ARB sells 1Mth bull bar

2018 – ARBs main warehouse is moved and expanded in Keysborough, ARB JACK is released.

2019 – ARB opens in New Zealand, ARB acquires Beaut Utes.

2020 – ARB acquires ProForm and Truckman.

Key Capital Allocation Decisions Since 1987

Buying back State Distributors

1988 – ARB acquires ARB Vehicle accessories Pty Ltd (NSW) – NSW distributor of ARB products for $140k.

1992 – ARB acquires ACT distributor for unknown amount but in ~$100k- $300k.

1996 – ARB acquires SA Distributor for $200k goodwill, its purchase price is paid off by the end of FY97.

2008 – ARB Acquires TAS Distributor for $298k goodwill, its purchase price of $1.35M included net assets of $1.07M

2012 – ARB acquires NT distributor for $565k goodwill, its purchase price was $854k.

Business acquisitions

1987 - Foundational acquisition at the start of ARBs journey and the reason for the IPO was the $2.5M raised to acquire ARB Air Locker – “Roberts Differential Lock”. This product is built into a core product line of the next 35+ years and will be come a ~$100M product line per annum. The two mechanical products in 2001 (Air Locker and Air Compressor) represented 20% of annual sales ($14M).

1988 – ARB acquires Old Man Emu Suspension product line for $200k, this goes onto become a key product line in the business product mix for suspension. In 2001 this was 20% of company sales ($14M), if this was maintained it would represent ~$100M of sales today.

2003 – ARB acquires Kinglsey Enterprises a supplier of 4WD accessory products for 4WD Vehicles, had been supplying the Australian market for 25yrs and own the Bushranger brand. Sales in 2003 were $10.5M. ARB paid $5.25M including $2.5M of net assets.

2009 – ARB acquires Thule Car Rack systems for Australia through a small automotive accessories business called Go-Active. Goodwill was $1.75M, total purchase price was $2.9M and Go-Active made $260k for the 6 months – ARB paid 3.4x NPAT.

2014 – ARB acquires Smart Bar from Hills Industries Ltd. A manufacturer of rotomoulded high density polyethelyne bull bars. It was bought for $2.5M

2016 – ARB acquires AutoXtras which manufactures long range plastic fuel tanks. It was bought for $2M of goodwill and total consideration of $2.1M.

2020 – ARB acquires Beaut Utes in NZ. Beaut Utes has been a reseller of some ARB products for a decade

2020 – ARB acquires Proform Plastics. Its not possible to tell what acquisition price was paid because at the same time ARB bought back 3 company stores. Collectively the 5 acquisitions generated $2.5M of NPAT and ARB paid $17M for them (Including $13M of Net Tangible assets acquired).

2021 – ARB acquires Truckman. Truckman has been operating for 35yrs and is UKs leading 4x4 accessories supplier particularly focused on Vehicle Racking and Commercial fit out. The truckman group has $27M of net tangible assets and produced $1.4M NPAT. ARB paid $48M for the business.

Sale and Lease back of key property investments

In 1989 ARB sell Croydon manufacturing and head office facility for $7M retires all debt and keeps $3M surplus + lease back of facility for 10yrs. Official Cash Rates at the time were 18%

In 1999 ARB Acquires a Kilsyth manufacturing facility land and buildings to be purpose built for $7M the sale price 10yrs ago.

In 2005 ARB sells and leases back Kilsyth facility. The site is sold for $16M.

In 2015 ARB buys back Kilsyth facility for $19M.

“In-housing” of products or business processes

1998 – ARB inhouse development of a ute canopy that was previously re-sold by another manufacturer. It was estimated at the time that the TAM for ute canopies was $20M and ARB had 5% market share ($1M of sales per annum). By 1999 this had grown to $2.4M in annual sales (12% market share). In 2000 ute canopy market share had grown to 15% market share, selling 350 units per month.

In 2001 ARB further deepened the “in-housing” of Glass and framing components of canopies to produce themselves. This increased gross margins on this product line.

In 2003 ARB ute canopies range became 7% of group sales ($6.3M of revenue)

2002 – ARB QLD distributor opens first retail store, and it trades “Very well” which prompts ARB to consider more direct retail.

2004 - ARB start a store rollout with two more sites, ARB acquires the land and buildings and company operates.

2017 – Flagship format is discovered and rolled out.

Why Choose ARB for your Vehicle

Design and Engineering: ARB invests substantial capital in research and design each year, the design and engineering team utilises the latest in CAD/CAM parametric modelling systems and finite element analysis packages and is supported by independent companies and universities for special projects like vibration, strength and crash testing. ARB also devotes substantial time and resources toward new projects around the world including IPF lights from Japan and Warn winches from the USA. We scan the globe in search of equipment that meets both the demands of our customers, our own stringent quality requirements and those of regulators. We also look to constantly improve our own business practices. We always endeavours to “raise the bar”.

Manufacturing: ARB is the number 1 innovator in the industry because we use the most advanced state of the art fabrication equipment and machinery. Todays requirements for more complex designs are met with highly advanced CNC sheet fabrication facilities. ARBs latest manufacturing capabilities include laser cutting, brake pressing, guillotining, CNC bending, machining and turning. ARB is equipped with MIG, TIG, Robot and spot welding facilities as well as powder coating and spray painting facilities. ARB has stringent quality control systems ensuring exceptionally high standards are maintained.

Will ARB be a Better Business in 5 years time

ARB will be a better business in five years because it has a 50yr old brand that has attracted a market leading position to retain its dominant market leading position to grow steadily via:

1) More Stores.

ARB has 74 stores nationwide now (30 Company owned and 44 Branded), ARB intends on opening 3-4 new flagship stores per annum, as they vertically integrate the retail component of their sale channel in Australia ARB have continued to pull sales from Stockists to ARB stores.

2) More Products

“Product development is a key element in maintaining ARB’s long term competitive advantage”

ARB internally research, design, develop, manufacture and retail a range of products in over 24 catagories including Bullbars, Side Rails, Towing equipment, Canopies, Ute Lids, Roof racks, Suspension, Driving lights, winches, air lockers, Cargo storage units, snorkels and others. In FY22 ARB released in excess of 160 new products and employed 100 engineers. I have included below a case study on the newly designed Summit Mk2 Bullbar.

3) More customers

ARB has achieved a OEM partnering deal with Ford and soon to be announced Toyota. This opens an enormous opportunity to sell into a market 10x the size of Australia in new vehicles each year.

Confidence Interval

High confidence interval on the outlook for ARB being better in 5 years. This is due to 2 main reasons:

1- Revenue Resilience. Consistent and reliable revenue each year over a long period of time reflects a strong business, it highlights that a business has a dominant position in its market and sells a product that has continual demand. Remarkably ARB has very rarely had negative growth revenue years (FY23 is its second only to 1991 which is not in CapIQ records):

1- Brand Loyalty. A customer can spend $100,000+ on a new vehicle and then proudly cover the front of it with an ARB branded protective bar. This brand affiliation is very strong and is the result of nearly 50years of product design and engineering to ensure that products look good. The brand reflects camping, off road, fishing, exploring culture and it has stood the test of time consistently selling at a +30% more price point than competitors.

2- Quality and Reliability unlikely to become less important. It is unlikely that a person after an accident or camping would be wishing they had a weaker bull bar or a roof rack that broke. The functional element of ARB products are important as it involves the integration with a vehicles safety systems like Airbags, sensors, radar, cameras. In some markets this is heavily regulated.

Is the Moat Widening or Shrinking for ARB?

ARB’s moat is getting wider across its business for the following reasons:

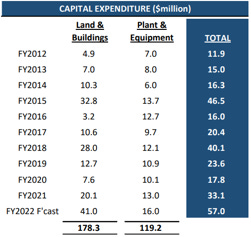

1- Accelerating Scale. ARB have invested the most in Capex in any year in FY22 – illustrating their acceleration in scale. ARB have the largest team of engineers focused on developing products in the broadest range of categories. According to some industry research there are 23 competitors in the 4WD accessories category and only 3 of them produce products across 11+ categories. The bigger ARB gets the bigger the R&D budget and the more efficient its manufacturing becomes.

ARB have spent cumulatively $450M on Capex and R&D since 2009, this enables them to release better products to market faster than competitors. For example, ARB had 60 different suspension configurations available for the new Landcruiser 300 series release.

1- Brand is getting better. In 2020 the ARB achieved a significant breakthrough by becoming the only steel bumper available for the Ford Ranger that meets regulatory crash test standards in the USA. This resulted in ARB being included in the Ford Licence Agreement and sold at point of sale through 1,000 ford dealerships in the USA further promoting the ARB brand alongside the Ford Brand which is over 120yrs old.

Management as Fiduciaries

ARB have built a culture of excellence and passion, however the below is all you need to know about how ARB management think of minority shareholders:

A Managing Director letting shareholders know they will be off work for a few weeks is exceptional treatment of minority shareholders.

Case Study on the New ARB Summit Bull Bar

What makes the difference in bullbars?

Lots of engineering goes into making sure they are ADR rated (Australian Design Rules) national standards for vehicle safety, anti theft and emissions.

Need to make sure a bar crumples to protect the chassis and not engage the airbag

The bar enables the vehicle to be driven after a crash and protects the radiator and also protect the passengers.

Need to make sure the bar doesn’t rub on the body of the vehicle and damage it when driving over bumps in the road etc.

Need to make sure the sensors and electronics still works like emergency braking etc.

The ARB summit Bullbar has had 4 years of R&D and over $1.5M invested in it.

ARB has a styling manager (Gavin Colgan-Smith) to make 4WD accessories look good, he has 15years experience and has been at ARB for 11 of those. He began working on the new ARB summit bar in 2018. A new team member Rob Dumaresq joined the styling team in 2019 to further enhance the design of the bar by changing the fog lights and grill design.

The design team also work on making sure the product is efficient to manufacture and easier to fit to the vehicle, Rob and Gavin travelled the country speaking with everyone they could from customers, manufacturing to franchisees to make sure they haven’t made any mistakes in design. The overwhelming feedback that they received was that the Summit bar v1 could take up to two days to fit because of the complex and integrated safety systems on new 4WDs and this made it hard for the sales team to explain to customers the long wait time for installation and obviously the cost. (The new Summit bar Mk2 cost $680 to fit vs $750 for the Mk1). The light cluster in the Mk2 is connected with a 6 pin connector resulting in much faster fitment. New Vehicles come packed with modern technology including sensors, cameras and radars and these need to be adapted into a bull bar without any interference with their functionality. And then all this integration must be recessed into the bar meaning that in a collision or animal strike that the steel is taking the impact not the integrated equipment. A further 2 years and $1+ Million was spent on removing the buffer point where the welds all joint together and also automate the production which results in 90% of the welds on the new bar being completed with a robot welder. This has been the strongest ARB bar ever produced.

As you can see below the ARB Bar sells at a 37% higher price than competitors.

Yearly Highlights from Annual Reports and Presentations

1987

ARB Air Locker acquisition completed (Formerly known as Roberts Differential Lock), international distribution agreements made and high-volume manufacturing equipment was ordered.

WARN International to distribute ARB Air Locker

Australian Patent granted

Design and manufacture of high capacity 12 volt compressor completed (to be sold with ARB air locker).

1988

Old Man Emu acquired (It appears that the goodwill associated with this acquisition was ~$200k

ARB Vehicle Accessories (NSW) Pty Ltd - NSW distributor consolidated into ARB group for ~$140k

Marine Engine development with Holden parts project commenced.

ARB sold in 19 different countries.

1989

ARB sells head office and manufacturing site for $7M, retires all debt with $3M surplus cash. Leases back for 10yrs plus 2x10yr options.

ARB employs first FT team member in USA to sell Air Locker

Invests in Australia’s first Mazak laser cutting machine.

1990

ARB completes a 1 for 14 bonus issue of additional shares.

ARB pays a 5.5c dividend for the year.

3000 square meter addition to the Croydon factory completed in February 1990 for more capacity and efficiency.

New Laser cutting machinery purchased for 12mm steel plate

NSW premises negotiation underway (Sales of NSW distributor are up 50% since acquisition in 1988).

ARB completed deal to distribute Flo-Fit Seats (USA), and IPF lights (Japan) in Australia. These products have been very well accepted and complement the portfolio of additional distributed products (WARN winches, Brahma Canopies, AVM free wheeling hubs and Fairey Overdrives).

ARB completed first OE contract

1991

First year of negative sales growth, a recession in Australia drove domestic sales down 6% over all but exports grew by 60% during the period. The increased production capacity exacerbated profit decline of 73%.

Explored an Insurance product that could be sold under ARB brand for 4X4 enthusiasts

R&D maintained during recession and profit declines.

Still paid a dividend of 3c.

1992

Cheap imports try to compete with Old Man Emu suspension product range, the competitions lack of quality and service resulted in a failure to gain traction. ARB old man emu growth returns strongly.

OEM bull bar revenue growing with Toyota and Nissan.

Canberra Off Road distribution business was bought to bolster ARB sales in the ACT.

A property was purchased for $720k in August 1992 to establish a new retail distribution centre

1993

Production plant in Melbourne extended to operate 24 hour days across 5 ½ days a week. This has reduced costs and improved gross margins.

ARB Air Locker and Old Man Emu products selling well in united states.

ARB 4WD insurance product selling well.

1994

New franchised outlets opened in Rockhampton, Townsville, Cairns and Artarmon.

ARB Air Locker models released for Hummer, Isuzu Jackaroo, Ford 10.25”, Dana 50 and GM 9.25”.

Old Man Emu suspension gained TUV certification in Germany making them approved for use in Europe.

Australian Army Bull Bars designed and manufactured as well as OEM products for Toyota, Nissan and Rover. Started work on developing Bull Bars for use with SRS Air Bag systems in new vehicles.

USA Operations expand distribution and warehouse facility. Inventory levels being built in secondary lines of product.

1995

Export division sales separated from group, is $5.5M out of $30M for the group (18% of group sales)

An additional Laser cutting machine and CNC lathe was purchased to relieve manufacturing capacity constraints.

4WD supply shifts from Japanese dominated to US and UK produced.

Suspension, Bull bar and Snorkel products released for Jeep Wrangler, selling commenced in USA.

Final trials for ARB air locker to suit Ford 9” diff. This was significant because the Ford 9” diff is a very popular Diff and no one has been able to develop a locking unit.

Offroad trailer suspension developed.

1996

Sales increased 16% for this year but were flat In Aftermarket Australia, Export sales grew 38% yoy and are now 23% of group sales.

ARB acquired South Australian Distributor and made it profitable in the first year plus started growing sales. Appears to have been ~$200k of goodwill and there was $1.2M spent on Property Plant and Equipment during this year.

“SA has always been a problem to the company due to the inconsistent endeavour of the independent distributors who have operated the business”, “We are confident the business will now flourish and we have budgeted to pay back the purchase price in less than 2 years.

ARB now owns the distribution centres in the following locations “we are pleased with all our distributors in other states”:

Croydon and Abbotsford VIC

Moorebank NSW

Fyshwick ACT

Mayne QLD

Norwood NSW

New suspension and bar work products were released this year to suit new 4WD vehicles.

A new range of ARB tow bars were released this year as well as the ARB Air Locker for the Ford 9” Diff and new ARB air compressor. The 9” Air Locker took 3 years to complete development.

New patented suspension system built on RAAF trailer.

1997

The SA distributor has been operated for almost 12 months and is turning over $2M this year, it will pay of the purchase price before the end of the financial year.

This SA distributor was bought on 1x forward earnings.

The 9” Diff Air Locker has performed well, advertising increased in USA.

New design 12volt Air Compressor has started selling 500 units per month vs 300 units per month for old model. Profit margins on new model are much higher than old design.

ARB Towmaster Towbar product designed and manufactured, previously ARB sold another companies product.

Head of Manufacturing and head of product development engineering manager appointed

ARB designing prototypes and tendering for trailer suspension systems for RAAF and other government bodies.

GKN Driveline Ltd (GKN Group) appointed ARBs distributor in the UK.

ARB Acquires an existing office and warehouse in Kilsyth Vic (8,900 sqm on 4.7ha) for $4,000,000, ARB intends on using half the building for its national warehouse and remainder is leased back to the vendor.

1998

US operations (Air Locker Inc.) sales grew 86% yoy due to new product mix and US economy strength.

Air Bag compatibile bull bar for land rover discovery released and has applied for patent protection on this product range.

Modular pack racks range released

Design and planning commenced for new 6,500 sqm factory to be built on new office site. ARB aims to bring all warehousing, manufacturing, and administration to this site. Contract cost of $2.1M and expected to be complete by January 1999.

Factory is now profitable each month

New product development has increased markedly under new head of product manager.

New SUV/4X4 model releases are creating requirement for new products to be developed.

Aus Aftermarket sales slow but OEM very strong.

ARB doubles size of Brisbane premises in July 1997

Distribution agreements are being reviewed and possible changes coming In 1997/98

“We believe that our business requires high stock holdings relative to industry averages for optimum performance, however, we are looking at strategies to reduce current stock levels without seriously affecting supply”.

Enormous number of new 4X4 models released requiring intensive product development. A new range of roof racks is released

ARB Become the distributor for Paratus Seats for 4WD vehicles.

Production capability enhanced with new Laser Cutting machines and Tube bending machine due for installation. Another laser cutting machine ordered to replace old equipment.

Y2K bug statement – assessed computer risks all okay.

“We are confident in our position as the market leader in Australia which we have further strengthened”

The entire Kylsyth facility will cost less $7M (Less than ARB sold their prior site for in 1989)

US operation upgraded to new premises with further 3,000 sqm of capacity. Still leased by the company.

Brisbane operations doubled in size since last year.

Significant manufacturing Plant and Equipment upgrade:

All 4 laser cutting machines are under 3 years old.

2 new computer controlled brake presses installed

Large 3 axis mandrel pipe bender purchased

2 new CNC lathes installed

Colour painting facility has been upgraded with high capacity bake off oven.

Current Batch shot blasting and powder coating facility will be sold.

Continuous chemical cleaning and powder coating plant to be installed in new factory.

Old plant almost all sold for above book value

“The most vital ingredient of ARBs past success has been the continued development of quality accessories for 4wd vehicles, we have increased staff numbers by 40% in this area to continue this success”.

We have models of Bull Bars and Roof Racks available for all major 4WD vehicles in Australia. Improvements continued on Old Man Emu suspension and Airlocker products.

For the past 16 years ARB were re-selling a ute canopy from the USA for sale in Australia, product quality has deteriorated to unacceptable levels as a consequence ARB have developed their own product line. The TAM for ute canopies in Australia is expected to be $20M per annum, we currently only have 5% market share.

Australian Aftermarket sales were subdued, exports and OEM was strong.

1999

New products released in all product families.

$5M spent during the year on buildings and Plant as outlined above.

Ute Canopies sales growing strongly.

Kylsyth facility expanding with 6,500 sqg manufacturing plant, wet painting operations, new showroom and sales offices, new engineering offices and workshops.

Total complex has building area of 17,000 sqm.

Total cost including car parking, buildings and renovations totalled $7.25m

New continuous powder coating facility designed, build and installed cost $700k, Old shot blasting plant upgraded for $100k, Wet painting facilities upgraded for $70k

These new powder coating and painting facilities mean that all production can now be powder coated in one shift operation. This has reduced workforce by 10 heads.

New leased premises in USA is 3,000 sqm which is 3x larger than previous facility. Still in Seattle.

Air Bag compatible bull bars now available for all major 4x4 models.

Aluminium side step released with new range of side rails.

Sales of Ute Canopies running at $200,000 per month ($2.4M per annum) expanded market share from 5% to 12% in under 12 months.

2000

Aftermarket sales and Export sales were very strong but OEM sales very slow as GST was introduced and reduced demand for new vehicles.

Since 1999 OEM orders are back to normal.

New products continually developed and released for all ranges.

Ute canopies now producing sales of ~$2.7M 15% market share and growing.

Wholesale sales tax converted to GST reduces product prices and stimulates growth.

The front vehicle protection “Sahara” bar is released. The Urethane buffers, light inserts and highly polished chrome top tube result in high tooling costs that make it very difficult for others to copy. We only build for a small range but this will increase.

Shipping costs of Sahara are much lower than other bars.

Exports now representing 34% of sales

We appointed a new manufacturing manager to oversea all manufacturing operations at Kylsyth

“The future of ARB will rely more and more on in-house manufacturing”

Kilsyth gets a further warehouse extension with a further 3000 sqm added.

ARB portable fridge/freezer range added to the Australian market. This product is manufactured by Sawafugi Electric Co in Japan.

ARB airlocker is one of ARBs most important products and we now manufacture over 12,000 units per year, 85% of which are exported with70 different part numbers. Some models haven’t been reliable enough so our engineers have developed a new 2 piece high strength air locker. This development has taken 2 years and exhaustive testing. This new product is patented and will be released at a 4x4 show in Las Vegas.

ARB has gained the reputation of being one of the world leaders in the supply of high quality 4wd accessories to our customers.

Recent speculation about regulation of bull bars in Australia. Likely to be introduced next year. Export Facilitation scheme finishing this year to be replaced by ACIS.

ARB now has 18 staff members working in product engineering and development.

ABR canopies are selling 350 canopies per month and accounts for 20% market share in Australia, up from 5% when the program began.

2001

Special dividend of $1.00 per share announced to release Franking credit balance, was underwritten by a broker and issued more shares (to increase liquidity).

Flagged re-fit requirement for DCs in Australia.

Canopies product range now selling 400 units per month. Furthering investment in “Glass Hardware” for rear doors, side windows etc, previously these products were imported from the USA and quality has been deteriorating. over 4 months the R&D team designed components to be manufactured by ARB at a cheaper rate.

Minister for Industry refused to grant ARB permission to participate in Automotive Industry Assistance Scheme which is replacing export facilitation plan.

Government effectively providing financial assistance to foreign and other locally owned companies in the industry to compete against ARB.

3000 sqm expansion at Kilsyth completed.

New 1600 sqm showroom and office at a new site in Adelaide is being planned.

New products continue to be developed:

Fabricated metal: Bull bars, Tow Bars, Rear Steps, side rails, Side steps and battery trays. Bull bars are the price of the product portfolio and at 2001 ARB produced 35,000 bull bars for the Australia market each year compared to about 145,000 4WD vehicles registered each year (The fitting rate is 60% resulting in 87,000 bull bars being sold each year giving ARB a 42% market share). In the aftermarket the Australian 4WD population is now around 1M vehicles.

Mehcanical Products: This product range includes Air locker, air compressor and other machined products. All of the products are owned, designed and developed by ARB and are manufactured in-house or via subcontractors.

Air-locker: This is the lead mechanical product and demonstrates ARBs engineering and product development expertise. In 1989 ARB Air Locker was awarded “one of the best products of the decade” by 4WD magazine and SEMA award. Air Locker is patented in several countries and is exported to over 50 countries in the world.

Air-Compressors: Best tyre pumping ability and highest air delivery capacity of mid range compressors on the market.

Old Man Emu Suspension Systems: This product range includes springs, shock absorbers, bushes, shackles and related hardware. All of these are owned, developed, manufactured and distributed by ARB and operate under the brand “Old Man Emu”. Manufacturing is mainly via subcontractors. This brand was purchased in 1988 and is now a leader in 4WD suspension set ups.

Traded products: These are imported and Australian brand name products such as Warn Winches, IPF lights, Hi-Lift jacks and AVM hubs. Australian brands include Safari snorkels, paratus seats, out of town tanks.

Some products are made for us under our brand including tow master tow bars, ARB freezer/fridge.

Canopies: canopies already discussed above.

ARB Customer Base: ARB customers are split into three main categories:

1- Domestic Retail (The Aftermarket)

2- Original Equipment Manufacturers (“OEM”); and

3- Exports

Domestic Retail (Aftermarket): In Australia this occurs on four levels:

State Distributor

Stockist

Dealer; and

Retail

ARB supplies the state distributors direct. State distributors are ARB owned in VIC, NSW, QLD, SA and ACT other states (WA, TAS, NT are independent). In turn stockists are located throughout each state and are supplied by the state distributor. Dealers are generally automotive dealerships which can be supplied by stockists or distributors.

The end customers are largely made up of recreational users, government, primary industries, mining, defence and trades.

The Non-OEM retail market makes up for approximately 53% of ARBs total sales.

OEM: this accounts for ~9% of ARB sales. Domestically Toyota, Nissan and Rover are OEM customers.

Exports: 38% of sales and USA is 60% of this. ARB in the USA is services by a wholly owned subsidiary Air Locker Inc. This subsidiary services re-sellers.

Exports to countries other than the USA are serviced from the head office in Melbourne.

ARB believes they have 30% market share of 4WD products (excluding Tyres and Wheels)

Competitive Advantages

Product Development and Quality

ARB is active in developing and designing new products for the evere evolving 4WD vehicles. New 4WD models ensure there is continual need for product development, new automotive technology features enhance this need for development spending (Lights, Sensors, Airbags).

ARB works closely with OEMs to design its product range to ensure availability at launch.

Most of ARBs products are unique and leaders in their field.

Brand

ARB and Old Man Emu have a reputation for outstanding quality and provides the broadest range of branded product.

Distribution

Extensive distribution has been developed over 26years.

Integration between Development, Production and Distribution

Vertical integration allows for supreme quality control.

Scale and Leadership

30% Aus market share and Export markets allow scale for lowest cost production and budget on R&D

2002

SA operations moved to new purpose built 1600 sqm showroom, warehouse and fitting facility on 5000sqm of land in Adelaide. SA is now 20% of sales. This new property was built at a total cost of $1.35M

Agreed to purchase a property in Canberra which when renovated will provide our ACT branch with new facilities including 900sqm of building on 1850sqm of land. This property was purchased for $1.05M

Agreed to purchase a new Queensland sales and distribution centre for total cost of $2.8M to relocate existing operations. Preliminary work has commenced. This property has a building area of 2400 sqm.

5 for 1 share split announced to “help liquidity”.

Focused investment on new products, more capacity and enhancing distribution systems.

Company Operated Sites:

State Distributors:

Kilsyth VIC – Company Owned

Moorebank NSW – leased

Mayne QLD – Leased

Regency Park SA – Company Owned

Fyshwick ACT – Company owned

Retail store:

Richmond VIC – Company owned

International:

Seattle USA – Leased (Air Locker Inc.)

For first time – company comments on the possibility of more retail stores.

Corporate Tax rate reduced from 34% to 30%

Capacity is constrained and the business is operating at the highest output.

2 acres of Adjoining land to Kilsyth is agreed to be acquired to allow for further expansion.

Independent distributor opens a retail store in South Brisbane and proves very successful.

During the year the manufacturing facility at Kilsyth was operating at full capacity so we bought two new Trumpf Lasers at a cost of $1.6M as well as more welding robots. This increased factory output from $75k per day to $100k per day (this is $4M of incremental gross profit produced for the year for a capital cost of $1.6M).

In the year ended 2002 we sold 12,500 airlocker units.

ARB are looking for very specific locations to open a company owned store in Melbourne and Sydney metro markets.

Invested additional $1.25M in 5 axis machining centre and vertical mill for air locker production and Eagle Tube bender.

2003

Sales growth at half year was modestly higher but profit growth subdued due to a sudden and significant increase in steel prices. Sale prices increased later in the year to offset this.

Construction of new Brisbane state branch commenced. Warehouse extension at kilsyth underway.

ARB will be manufacturing its own windows and doors for canopies from later this year, this will improve margins for the canopies group and increase quality and flexibility.

A drought in Australia, a War in the Middle East and a rapid appreciation I the AUD were huge headwinds this year. However, ARB grew profits by 24.3%, this growth in NPAT was due to Low fixed cost investment, Re-sourcing/ renegotiating some component parts, Price rises.

Manufacturing of windows and doors commenced and demand for canopies is growing rapidly resulting In increase capacity being planned.

Abbotsford retail store refurb planned for 2004, Air Locker Inc moved to larger premises, continuing to look for two sites in Melbourne and Sydney for retails stores.

ARB franchised store in Brisbane drove a strong QLD sales result for the year +19.3%. yoy.

Marketing department expanded to 5 people, “we were launching new products but not telling anyone about them”, much of the creative content of our catalogues, advertisements, brochures and packaging is handled in house.

These new sales tools with a vastly improved website has improved retail sales.

The total investment in Brisbane showroom and office was $3M

Projected budget for Kilsyth manufacturing expansion $3.5M and will add 7,100 sqm of space, this takes total building area to over 26,000 sqm on 5.5ha of land.

4 years ago ARB decided to replace the imported and resold Brahma Canopy, this product range now makes up 7% of group sales and ARB are selling about 600 units per month. We have just started manufacturing the doors and windows for these also.

We must continue to develop more products and innovate but also invest in ensuring our costs to manufacture are kept to a minimum, to achieve this we have invested in $2.2M of automation equipment for our manufacturing facility.

ARB start to discuss the power of ARB brand with 4WD resellers and the consideration of making them exclusive to ARB and rebadge their business.

ARB Announces the Acquisition of Kinglsey Enterprises:

Kinglsey is a supplier of quality accessory products for 4WD light commercial vehicles. Kinglsey has been supplying the Australian marke for 25yrs and have 5,000 products including the Bushranger brand. Sales revenue in the 2003 year was $10.5M and the business is based in Bankstown and employs 50staff.

Russell Foxe is the Kinglsey Founder, Vance Williamson the CEO are still managers of the business standalone.

ARB issued 136,796 @ $3.39 ($463k) shares and pay the balance in cash.

Kinglsey was acquired for $5.25M and had $2.5M of net assets. $2.7M goodwill.

Three main product lines: 1- Side steps, 4WD accessories sold under Bushranger brand, Aluminium framed windows for vans and RVs

Robert Fraser is appointed as a director of ARB.

ARB states they are focused on expanding ARB branded independently owned store network. These stores agree to certain standards.

2004

ARB Operates 6 company owned retail stores in addition to “many” franchised stores.

ARB identifies two site for next roll out:

Wentworthville in Western Sydney, total cost of land and buildings will be $3.5M

Morphett Vale in Southern Metro Adelaide, total cost of land and buildings will be $2.2M

More sites being identified.

ARB comments on wanting to buy USA site.

Increased Capex investment forecast for more store rollout, facility upgrades and expansion.

Steel price rises: steel is the major raw material for ARBs product range, most steel suppliers increased prices by 10% in late 2003.

ARB currently spending $250,000 per month in product development and engineering.

ARB states they are looking for more companies to acquire that have products to be sold through our distribution system.

Land acquired in Smeaton Grange south west of Sydney to design and construct a new office, factory and warehouse for Kingsley enterprises, total cost of the land and buildings is budgeted at $6M. Expected to improve production capacity and manufacturing efficiencies.

New Warehouse facility acquired in Seattle for Air Locker Inc.

“Best performing stores for the year were the new or recently refurbished ones”

“Sales growth for Brisbane, Canberra and Adelaide was 24%, 20% and 21%. These growth rates are way better than average and are very encouraging”

ARB branded franchise stores in Tamworth and Woolongong were opened and St Peters Sydney and Albury Victoria.

“Our old facility in Moorebank west of Sydney had a slow year in 2004 and is not a great place for customers to visit or for our staff to work”.

ARB operates very well at 70c USD and 58c EUR

900 extreme driving light range developed by ARB and IPF Japan.

New Towbays with swing away tyre carriers developed by ARB.

ARB are recruiting apprentices to train on site and investing in automation due to lack of staff availability.

20c Special dividend paid and DRP and bonus share plan offered.

2005

Sale and leasback of Kilsyth facility executed. The site is sold for $16M. Directors believe that because the development of the site is fully complete there is no need for ownership. This will result in a $2.6M profit after tax.

Richmond retail branch is sold and leased back. The Richmond site is sold for $4M resulting in a profit of $1.6M.

Two new ARB products that were released caused losses in the manufacturing division until they were successfully scaled up.

Kinglsey Enterprises lost a large OEM contract which affected its performance in the second half, Kinglsey is now placing more emphasis on importing and wholesaling rather than manufacturing. Planned relocation is deferred and land that was bought for this relocation has been sold.

Air Locker Inc. Moved into new warehouse and office facility in Renton Washington.

New showroom site acquired in Brighton Victoria and refurbished and opened. This store became profitable after two months trading.

ARB mention Thailand as a future product facility expansion area. Expecting to commence in 2006. Start up investment expected to be ~$4M. A large number of the pick up trucks sold throughout the world are produced in Thailand. There is a very strong local market in Thailand for these vehicles and accessories also. The Thailand factor will produce products for the US market and Thailand market.

Kinglsey sales +66% on prior year (although only 7 months in prior year).

ARB has 22 branded stores and 7 company owned with a further 2 being constructed. A large number of independent stockists as well.

“In the US there is an extremely strong 4WD enthusiasts market” we are building more barwork and suspension products for the big US vehicles which still sell in large numbers.

2006

Escalating fuel prices have caused a headwind on our results.

Offroad accessories Limited established as an ARB subsidiary in Thailand for the purpose of establishing a second manufacturing facility. A near new factory has been purchased in the Eastern Seaboard Industrial Estate in Rayong Province. The factory is 3,600 sqm and can expand a further 5000sqm. Still expect this to cost $6M.

During the first half 3 new ARB franchised stores were opened:

Morphett Vale, SA

Two other independently owned stores.

There are now 24 ARB branded stores in Australia, 8 are company owned and operated.

ARB acquires the business operations of its previously independently owned WA distributor this takes company owned stores to 9 and 24 branded.

Acquired for $2.5M and will add sales of ~$6M to ARB group in 2007.

ARB continues to spend $250k a month on R&D $3M p.a

Andrew Stott Appointed Director

Ernest Kulmar appointed director

$345k expensed through P&L for non-capital start up costs of Thailand Plant, expect it to be break even 3rd quarter of 2007.

ARB opened 5 new ARB stores and now has 28 ARB stores around Australia with 9 owned and 19 franchised.

Kinglsey lost 13% of sales volume from loss of OEM contract.

Output has not increased to the extent planned by ARB due to labour shortages. We have a strong core workforce in Melbourne but to expand is difficult.

2007

Market update provided on 23rd Jan a revenue increase of 18% over prior year. WA contribution +soft last year.

ARB product sales in USA remains strong

Anticipated release of the 200 series land cruiser. New products being developed for this model change.

Kinglsey business relocated to Ingleburn NSW to improve operating conditions and new product releases found to return this business to growth.

A further franchised store added to the network. ARB acquired St Peters Franchise in Sydney late in second half. 29 ARB branded stores in Australia and 10 company owned and operated.

Kingsley returned to growth toward end of the year.

ARB agreed to purchase Tasmanian Distributor

Wentworthville store in Sydney opening in 2008.

Up to 2007 Annual Report

2008

ARB has agreed to purchase TAS distributor will be effective from October 2007.

Thailand plant expanded by 6000sqm to take it to 9,500 sqm in addition to the 12,750sqm at kilsyth.

Ongoing skills shortages plaguing Kilsyth Manufacturing facility.

Now 31 branded ARB stores in Australia, 13 company owned. “Further stores will be added with an emphasis on quality not quantity”

ARB has taken over the ARB Tasmanian distributor

Also taken over the Albury NSW store.

In both cases ARB have acquired the Freehold as well.

ARB has by far the strongest distribution network in Australia of 4WD accessories.

ARB have started selling direct to USA new vehicle dealers, looking at a second warehouse to service the East of the USA. ARB selling $295 per light truck in Australia and only $3 per light truck in the USA.

As at 30 June 2008 there was 33 ARB branded stores, 13 company owned.

Additional 2 since mid year were Port Macquarie and Ballarat.

ARB embarking on big Capex program to acquire two additional retail stores including Freehold, refurbishment of other stores, building of Wentworth store and expansion of Thailand factory.

ARB claims high Fuel prices and high steel prices as significant headwinds for the business.

“Some softenining in demand experienced in USA and Europe due to the subprime crisis” demand in Melbourne and Sydney is weak. This has been more than offset in states and areas where Oil and Gas or mining is going strong.

We believe our business has:

Strong Brands around the world

Strong distributors locally and internationally

Strong Balance sheet

New product development

Very capable senior management team and staff.

Looking to open new warehousing facilities in Adelaide and Brisbane to cope with increased demand.

2009

ARB acquires Thule Car Rack Systems for Australia through the purchase of a small automotive accessories business. Thule car rack systems are a world renowned product range manufactured in Swedan AB.

Transaction took place on 30th September 2008

Should provide sales revenue of $9M

Thule has been selling in Australia for 20years.

40% of sales growth at half year was due to new stores and the acquisition of Thule, the remaining 60% was organic.

New ARB franchised store opened in Bairnsdale Victoria. 34 ARB branded stores, 13 company owned.

Worldwide slow down in new car sales has slowed production of manufactured products from Aus and Thai facilities.

ARB Portable Fridge/freezer released. And new Nitro Charger sports shock absorber released. Portable Fridge/Freezer product was developed over 3years and has been very well accepted by the market, Nitro Charger is replacing a product that has been in market for 20yrs also building up well.

During the GFC Large and Ute 4WDs new vehicle sales dropped significantly, during this time ARB Australian Aftermarket sales growth of 18.5%. “we took market share during this time at the expense of competitors”.

As at 2009 50% of ARBs sales were made up of Accessories manufactured by the company. During 2009 the mix shifted from manufactured products to resold products as most of the manufactured ARB products are reliant on new vehicle sales.

ARB notes labour market loosening in Australia in the wake of the GFC.

During the GFC fuel prices dropped materially which increased orders for large and ute 4WDs and also increased the interest in camping and 4WD because of its perceived affordability as a holiday.

ARB benefited from the Government stimulus packages.

Number of branded stores increased to 35 with two new franchised stores opened in Bairnsdale and Maroochydore.

ARB offroad established in Thailand to sell direct to the Thailand, Laos and Cambodia markets.

The 4WD Utility market vehicle sales has proved very resilient during the GFC, This market still declined but not near as much as passenger vehicles. “ARB aftermarket segment has held up surprisingly well considering the new vehicle sales are down by over 30%”

40% of sales are ARB manufactured.

New Warehouse and Canopy building facility was established in Adelaide in Regency Park.

Kilsyth operating 5-6 days a week 3 shifts. Thailand operating single shift 5 days a week.

2010

ARB Australian market very strong but US market has been seriously impacted with sales in the USA down 10% in USD and 20% in AUD.

ARB leases new facility in CanningVale Perth for 4000sqm facility. This facility is a showroom, warehouse and fitting facility.

ARB leases additional 5000sqm property near kilsyth for increased warehousing and canopy building.

ARB leases 3000sqm warehouse space in Moorebank Sydney.

39 ARB branded stores, 14 company owned. 5 additional ones:

Canningvale WA

Dubbo NSW

Hobart TAS

Keilor Park VIC

Toowoomba QLD

Significant rebound in Australian Aftermarket (+29%), strong sales growth of new vehicles, Fed Govt investment allowance, Stimulus.

OEM strong this year +40% off back of low base in 2008/09. Strong growth of new 4WDs and government allowances (writeoffs)

NPAT this year was +45%

2011

ARB Cairns acquired by the company and operated from November 2010.

ARB stockist in Mandurah WA purchased by the company in December 2010.

As at 31 December 2010 41 ARB stores 16 company owned.

We have had strong market share growth at the expense of our competitors.

A second vehicle supply disruption from Japanese Earth Quake, this disaster has halted the production of small but vital parts which has stopped vehicle production in many parts of the world.

ARB has established a second plant in Thailand, This factory will be located in the same industrial estate as the existing plant (acquired 14,000 sqm of land and a plant of 9,000 sqm will be built in next 6 months).

Bumper years of profitability following tough vehicle supply in 2009 catching back up.

40 ARB branded stores with 15 being corporate owned. (Richmond store was closed and is being transferred to surrounding stores). Well over 100 independent stockists.

Sales volumes of new vehicles were strong but would have been stronger had Japan earthquake not happened.

ARB releases new product segment for under vehicle protection systems, also expands Fridge/Freezer range and releases a modular range of roller drawer systems

Since 30th June 2011 a further 3 stores have been established:

ARB Welshpool WA

ARB Burleigh QLD

ARB Orange NSW

Presently 43 ARB stores in Australia, 16 company owned.

2012

Thailand flood affects the supply of 4wd utility vehicle manufacturing, 80% of all 4WD utes are manufactured in Thaland

ARB reports a +3% sales growth for the 9months to March 2012.

ARB has 43 company owned stores with 16 company owned.

Opened Welshpool WA

Burleigh Heads QLD

Orange NSW – new corporate

Closed Abbotsford/Richmond in Melbourne.

Aus aftermarket continued to grow on back of strong growth in last 2 years, this was achieved by:

New ARB stores, Strong Marketing, Release of new products and taking market share.

Two new stores earmarked to be opened in next 6 months from May 2012.

Company owned store in WA

Privately owned store in QLD

Cairns has been relocated to a larger company owned property that has been extensively renovated.

ARB Launnceston extensively renovated.

“warehousing capacity still constrained”

Building a new 17,500 sqm facility in Thailand

Andrew Brown appointed Managing Director

After comping the past two years NPAT is flat +1.7%

Encountering Vehicle supply crisis which hampered new vehicles delivered from November 2011 – March 2012. After supply resumed there was a spike In demand for ARB products which exceeded manufacturing capacity to satisfy.

ARB has 44 Stores 16 company owned, after opening Orange NSW, Bundaberg and Burleigh Heads and Welshpool.

In July 2012 ARB acquired the business of Top Gear Car and 4WD accessories in Alice Springs NT. “Not Material”

New ERP system being install with a new IT manager appointed, New “in house” legal counsel appointed, Supply chain manager appointed.

2013

Company has 45 stores now incorporating the Alice Springs NT store, 17 company owned.

Planning for one further store before end of the current financial year – Added in May 2013 in Wangara WA.

New Thailand warehouse and factory building of 17,500 sqm is ready for fitout.

“Still a number of locations around Australia where ARB is under represented, a new manager of NSW has been appointed to upgrade corporate and licensed stores”.

Capacity of warehousing constrained again.

ARB purchases the Ballarat Victoria store and takes ARB stores to 47, 19 company owned.

OEMs impacted in Australia due to cut backs in mining industry

Construction completed on the 17,500 sqm manufacturing facility in Thailand.

ARB ERP system installed and progressing well.

2014

“ARBs market-leading store network is pivotal to the companys strength in the Australian Aftermarket”. We expect a further 2 new independently operated ARB stores will be established this financial year. ARB has agreed to acquire Welshpool WA.

Warehousing capacity in QLD to be expanded.

New company owned warehouse in Brendale QLD.

Moorebank facility acquired by ARB and will be upgraded.

Prague warehouse established for Eastern European markets.

Second warehouse in Jacksonville Florida to service south America and central America.

At half year 48 stores, 20 company owned.

Hoppers Crossing Vic new independent

Broken Hill NSW new independent

Welshpool WA purchase by the company

Aiming to open on more in QLD and VIC

ARB looking to acquire Darwin Distributor from the current independent owners.

This will bring back control of distribution to the company in all states

ARB looking to expand warehousing capacity in Adelaide SA.

Ford Ranger Ascent Canopy released for the Dual Cab Ute.

Capital Allocatoin Framework:

Earnings accretive capital projects

Suitable acquisitions of products or businesses

Capital management initiatives.

At year end two new stores opened one in Pakenham VIC and Biggera Waters QLD. Taking total stores to 50, 21 company owned.

ARB announces the planned release of the BP-51 shock absorber range, it is an aluminium bodied, remote cannister shock absorber incorporating by-pass technology. CAPEX spent in Thailand for production. It has taken over 4yrs to develop.

ARB acquires ‘Smart Bar’ from Hills industries ltd in 2014. Smart bar are the manufacturer of a unique range of rotomoulded high density polyethelyne bull bars for a range of vehicles. Small volumes but we can grow it substantially via our distribution network.

2015

ARB acquires 42-44 Garden Street Kilsyth Victoria for $19M. ARB currently leases this site. (This site was sold for $16M in 2005 10yrs ago).

At half year end ARB has 51 stores, 22 company owned.

New company owned store opened in Burnie Tasmania.

Refurb leased warehouse in Liverpool NSW opened in Nov2014.

Ascent Canopies continue to gain market share over the next 12 months this model range will be expanded to cover most Dual Cab utes.

2014/15 will see a significant number of new vehicle releases occurring. These are big opportunities for ARB.

Damon Page appointed CFO.

3 new licensed ARB stores planned to be opened before the end of the Calendar year

Store upgrades ongoing. Substantial warehousing capacity upgrade taken place. Important to make sure customers are supplied on a timely basis.

ARB releases bull bar range for big three USA trucks Chevrolet, Dodge and Ford. These have started slowly but large opportunity ahead.

ARB R&D engineering team is now 35 with additional 20 production engineers.

4 models available for Ascent canopy, a further 5 coming to market in next 12 months.

BP51 shock absorbers demand is outstripping manufacturing capacity.

New Summit Bull Bar released, ARB also released Summit Rear bar

ARB store network expanded to 52 stores, 24 company owned.

ARB aluminium bull bar range released.

Marketing step up in the USA in addition to strengthened sales teams in Seattle and Jacksonville.

Production component of head office is 12,200 sqm plus two leased sites next door.

In Thailand manufacturing site is 17,000 sqm

Marketing team all in-house producing 200,000 hard copies of ARB catalogue, all advertising, packaging, logos, POS material, show stands as well as strategy and promos.

$46M spent in 2014-15 (“A year of transition”).

Kilsyth office, warehouse and factory.

QLD DC

SA DC

New Ballarat store freehold

Manufacturing equipment in Aus and Thai

2016

The influx of new models created issues for ARB to keep up with a full range of accessories for all customers in a timely manner. We should catch up over the second half.

ARB sells Seattle warehousing facility for $1.2M profit and leased nearby facility for an extra 50% of capacity.

At half year ARB has 53 ARB stores, 24 are company owned.

ARB acquires Manufacturing business Auto Xtras.

AutoXtras make roto moulded long range plastic fuel tanks. The product range has been expanded:

ARB increased R&D Engineering team to 40 plus 20 production engineers.

At year end there were 56 ARB stores in Australia, 24 company owned.

ARB needs to address warehousing capacity in Victoria and WA.

Limiting factor to growth in Australia has been fitting capacity

ARB establishing a sales and DC in Dubai to service Middle Eastern region.

ARB acquires 55sqm of land next door to Thailand factory for expansion.

Growth from Europe has been a highlight for export division this year.

“Export sales a top priority for ARB”

Implemented Design Engineering capability in the USA to cater for that markets special requirements.

Maintenance Capex expected to be ~$10 - $12M per annum.

2017

Construction of 16,000 sqm facility soon to be commenced in Victoria. Other leased facilities to be consolidated back to ARB headquarters.

A new sales and fitting facility in Canningvale WA has been purchase and is being renovated.

At half year there were 58 ARB stores, 25 company owned.

New VIC warehouse to be in Keysborough VIC.

“Profit negotiation in Thailand occurs during the second quarter of the financial year and this interrupted production this year”

Fitting capacity restraints caused by increased complexity in fitting automotive after market accessories

New store format progressively to be rolled out across network:

US operations showing steady growth.

ARB R&D engineering team now 40 + 20 productio engineers. Spending $6.8M on R&D in FY16. (21% increase on FY15) representing 2% of revenue.

Smart Bar Manufacturing facility is in Adelaide.

New ‘Elements’ fridge/freezer constructed in stainless steel

Production operating at full capacity in Aus and Thai.

Maintenance Capex is $9M pa

ARB store network now 61 stores with 25 company owned.

Newest stores include new Livery, Technology and custom joinery. This design includes product category signage, pylon signs

New company owned retail store with large fitting capacity to open in Canning Vale Perth WA.

New stores opened in:

North Lakes QLD

Springwood QLD

Geelong VIC

Shepparton VIC

Thornleigh NSW

ARB have standardised a store presentation format which has been very well received and enhances customer experience.

US management team performing well.

ARB now employ 60+ engineers. Increased R&D Spend to $7.3M during FY17. Maintained at 2% of revenue.

Maintenance capex of $10M and Growth capex of $11M

2018

LINX product released, a unique modern controller that declutters the dashboard and centralises the command of vehicle accessories by replacing classic switches, gauges, monitors

$27M spend on investment in property plant and equipment.

Tailgate Assist product released, Jack product released.

Work to commence on 20,000 sqm warehouse in Thailand.

ARB aims to open 7 new Aussie stores over next 12 months.

Jeep HL Wrangler specifically air freight a vehicle across to ARB to work on early development package of accessories

We get it branding campaign reminding customer of passionate franchisees

ARB opens large retail store in Thailand – the largest privately and indenpendantly owned 4x4 accessories store in Thailand.

63 Stores in Australia, 25 company owned.

New products and accessories released weekly into the companies factories for manufacture ready for new vehicle model releases.

Total new stream of product releases throughout the year were LINX, ARB tailgate assist, ARB hydraulic JACK, Summit RAW read bars.

Company has invested heavily in FY18, $28M Land and Buildings (including $20M warehouse in keysborough), $12m in plant and equipment, $21M increase in invesntory.

US operations showing steady growth.

ARB R&D engineering team now 40 + 20 productio engineers. Spending $6.8M on R&D in FY16. (21% increase on FY15) representing 2% of revenue.

Smart Bar Manufacturing facility is in Adelaide.

New ‘Elements’ fridge/freezer constructed in stainless steel

Production operating at full capacity in Aus and Thai.

Maintenance Capex is $9M pa

ARB store network now 61 stores with 25 company owned.

Newest stores include new Livery, Technology and custom joinery. This design includes product category signage, pylon signs

New company owned retail store with large fitting capacity to open in Canning Vale Perth WA.

New stores opened in:

North Lakes QLD

Springwood QLD

Geelong VIC

Shepparton VIC

Thornleigh NSW

ARB have standardised a store presentation format which has been very well received and enhances customer experience.

US management team performing well.

ARB now employ 60+ engineers. Increased R&D Spend to $7.3M during FY17. Maintained at 2% of revenue.

Maintenance capex of $10M and Growth capex of $11M

2019

Andrew Brown is going to be calling In sick for a while.

Increased warehouse space in WA required so have entered into heads of agreement for a new larger purpose built ware house at no incremental rental cost

ARB experience days introduced to train customers and distributors to learn more about the functionality of ARB products.

ARB Narellan NSW latest store in the network decked out in new store format, 3,000 sqm showroom, office and warehouse.

R&D to continue at about 2% of revenue.

Company invested heavily

“Trade wars” helping ARB meaningfully because all of ARBs products are manufactured in Thailand or Australia not China like the competitors.

65 ARB stores at half year, 25 company owned.

4 new licences stores:

South Hedland WA

Warragul Vic

Narella NSW

Woollongong NSW

These new stores were all purpose built according to our stringent frmat and presentation requirements, this illustrates the confidence and willingness of private ARB licensed store owners to invest in the ARB brand.

New 20,000 SQM global warehouse facility construction commenced.

BullBar development now becoming very complex, including Park Assist Sensors, Radar, Cameras, Adaptive cruise control cameras, Emergency Break Assist and lane departure.

International subsidiaries have strong and settled management teams.

Engineering resources focused on range and speed to market.

ARB continues to invest actively in infrastructure, marketing and support for key export markets.

ARB develops products in partnership with OEMs, these typically carry the OEM brand. They have lower margins but contribute to factory recoveries. Example clients are:

66 stores at year end. Additional since half year at Bunbury WA.27 company owned.

3 Flag Ship Stores in FY17

5 Flagship stores in FY18

7 Flagship stores in FY19

Export Sales growing at 13.3% since full range of bullbars released in FY15 and US management team in place.

A collaboration with Ford North America for a Winch Compatible bumper.

A total of 128 projects underway for product development

Thailand 21,770 sqm warehouse completed with land adjacent available for future development.

2020

ARB acquires Advanced Equipment Limited trading as ‘Beaut Utes’ – New Zealand. Beaut Utes based in Hamilton NZ and includes a operations in Auckland, Christchuch and Hamilton. Auckland includes a retail showroom. Advanced Equipment makes Pick Up bed covers such as Canopies and Hardtops.

Beaut Utes has been a reseller of ARB Classic and Ascent Canopies

Beaut Utes employs Circa 50 staff and provides a solid foundation in NZ for all ARB products.

Ford Performance makes announcement of collaboration with ARB for off-road parts starting with the Winch Read bumper for Ford Ranger.

Integrit Powder Coat (registered trademark)

New Vehicle market was extremely tough posting the 22nd consecutive month of declines, SUVs and 4WD remain relatively flat. Aftermarket still grew 2.8%. OEM sales also tough because of lower car sales volumes.

Company acquired two ARB stores from an independent owner in Rockhampton and Bundaberg QLD.

Company is expecting six store upgrades to flagship format during 2020.

ARB relocating WA distributor to larger premises in December 2019.

ARB acquires Proform Plastics Ltd based in Hamilton NZ.

Proform provides customers with a complete large plastics service from Design, tool making, production and international logistics with approximately 120 staff.

ARB have been dealing with Proform since 1997 with the introduction of Profotm Canopy shells into the ARB product offering.

This is not financially material but strategic as it secures the companies supply of canopy shells. And allows for more products to be developed with the expertise in large plastic sheet manufacturing.

30 March 2020 – COVID 19 – ARB withdraws guidance and cancels interim dividend. Stock trades down from $20 per share to $13 per share.

All Directors took 50% reduction in remuneration, remaining directors took 30% reduction and Senior management will take 30% reduction in remuneration.

Customer orders collapsed in April 2020 across the world as customer canceled orders and destocked. But then customer orders rebounded in May 2020 to record levels. This resulted In complexities In managing the business and we were unable to meet customer demand.

ARB releases a range of new sport lids from BeautUtes range

Beaut Utes now reselling full ARB range in NZ.

8 stores fitted out in Flagship format this year.

A new store was established in Windsor NSW Total ARB stores at 67 of which 27 are company owned.

Base Rack modular roof rack mounting system and Intensity Solis LED Lights with Flood and Spot variants connected to a dimming controller released. Proform plastics allowed for new product innovation to the engineering team as well as the release of the SportLid V to global markets.

Total Business combinations for FY2020:

FY2020 tough year for new vehicle sales with many main models down 5%-10%

THULE product range traded really well as more camping/outdoor spending.

8 Stores upgraded to flagship format

Joint work on US compliance obligations for OEM critical safety parts is complex but nearing completion for launch in 2021.

“ARB has good visibility on OEMs transition to EV as it relates to aftermarket accessories”

One of ARBs competitive advantages is the ownership and expertise of proprietary manufacturing, the factories in Aus, Thai and NZ can flex lower and higher as well.

State of the art manufacturing capability is added each year for efficiency and quality.

2021

ARB is benefiting from pent up demand created by global shut downs + Stimulus payments

At half year there was 69 ARB stores and 29 company owned.

Two new stores in Gosford NSW and Edwardstown SA, and one independently owned store in Windsor NSW.

ARB has commended building a new flagship store in Wangara WA and Seven Hills NSW. Land has been acquired in Albury NSW and Alice Springs NT to relocate existing stores into larger flagships.

ARB acquires Auto Styling Truckman Group Limited T/As Truckman.

Maximum net cash for purchase of $48.1M AUD including $35M upfront + $13M contingent on prospective earnings.

Truckman employs 80 staff and the acquisition includes the 4900 sqm head office and central distribution center in Birmingham UK. Truckman was founded in 2002.

Truckman had net tangible assets of $27M and produced a profit of $1.4M after tax for FY2021.

Ford Motor Company announce collaboration with ARB to develop full suite of premium aftermarket products for the all-new Ford Bronco. This collaboration allows a portfolio of innovative accessories ready for customer launch.

The full suite of Bronco Accessories fro ARB will be available to new Bronco customers this summer through >1000 Ford Dealerships and ARB authorised resellers throughout North America.

ARBs philiposphy is unwavering Quality, Reliability and Practicality.

Ford announce that ARB branded off-road accessories for Ranger and Everest Vehicles will be sold as Ford Licensed accessories through participating ford dealers in Australia for second half of 2021 with other Ford Markets to follow.

A range of ARB 4x4 accessories to become available from Ford dealers in 2H 2021 covered by Ford Australia’s new vehicle warranty of up to 5 years unlimited ks. Accessories validated by Ford Australia engineers.

Ford backed ARB accessories will become available via participating Ford Dealerships in 2H 2021.

ARB opens ARB Highbrook in Auckland NZ

ARB core values

DRIVE – we collaborate, we are determined, and we think ahead

EXCELLENCE – We are innovative, we are flexible, and we keep trying

PASSION – Safety matters, we are loyal, and we are proud.

Three new stores established this year in Gosford, Edwardstown and Cockburn WA This brings total store count to 70 of which 29 are company owned.

Significant R&D capacity was consumed in the development of a comprehensive range of ARB and Old Emu products for the updated Hilux, D-Max, BT-50 and Navara.

Engineering and design underway for full suite of premium Ford Bronco product in the USA.

New releases underway for LC300 and Ford Ranger.

Construction underway for new 30,000 sqm factory in Thailand. This will further increase efficiency of Thailand operations.

John Forsyth long standing director retires.

At year end 70 stores nationwide, 29 company owned. 29 flagship stores.

USA exports sales grow rapidly +46% yoy.

New 3,000 sqm engineering R&D centre to commence construction at corporate head office at Kilsyth.

ORA4 (Offroad accessories site #4) to be completed by Dec22 covering 33,250 sqm.

ORA5 4,200 sqm manufacturing site.

2022

Half year – 72 ARB stores, 29 company owned.

New independently owned stores in Sale VIC and Cockburn and Karratha WA. All three are flagship format. 31 flagship format stores

FLA in Australia has commenced during the half

USA growth continued +22% half on half

Sales through FLA are steadily increasing and in line with expectations.

ARB will provide a wide range of products available for the Ford Ranger and Ford Everest to be released in June 2022 and August 2022.

FLA will roll out in NZ later in CY22.

Kilsyth expansion plans:

ORA4 Thailand Factory Expansion:

We are challenged by global shortage of new vehicles. Commodity prices and availability, global logistics prices, labour shortages.

Capex Budget and historicals:

2022 NZ Factor and Thai Factories.

ARB has 73 stores in Australia 100’s of stockists and 100’s of dealers.

LC300 released and we have full range available from day 1. Volumes of available vehicles is heavily constrained.

Ford Ranger launches in Q2 2022 Ford Everest launches in Q3 2022.

ARB have early vehicle access ad first to market with full suite of 4x4 accessories

Ford Bronco OEM development for full range potentially available through over 1000 dealers. Vehicle availability still limited.

“Emerging partnerships with major customers”

Lachlan McCann appointed as CEO of ARB. Commenced with ARB in 2001 and has worked his way up.

He will be paid $850k AUD.

Distribution centre in Texas our third in the USA. This allows us to reach any US based customer in two days. 4000sqm 20miles southwest of Dallas. Expected to be completed by October 2022.

Significant supply chain challenges, New vehicle availability and personnel absenteeism.

Sales into export markets were also affected by war in the Ukraine.

Ends financial year with 74 stores 30 company owned. 34 Flagship stores.

Enormous CAPEX of $58M on Property Plant and Equipment.

Franking Account has $75M of franking credits, could support a Special Dividend of ~$220M ($2.75 per share).

Lowered Discount Rate on Impairment testing for Intangibles.

Ford Ranger and LC model changeovers have resulted in lower volumes. Overall car volumes still below FY18 levels in total and for 4WD SUVs

USA Export sales growth of 27% yoy

Toyota North America and ARB agreed to “Commercial relationship”

Expecting 4+ all new long term products to be launched in FY2023.

Thai Factory is 83% complete at August 2022

US Sales Surpass $100M up a further 19% yoy.

4Wheel Parts retailer of 4wd accessories in USA sold to Wheel Pros – this was very disruptive but has since recovered.

Toyota North America Associated Accessory Products (AAP) to be announced at SEMA 2022

ORA4 Thailand on schedule to be completed from December 2022. This state of the art facility provides 33,250 sqm of manufacturing.

Exports are lower by 19% in Q1FY22 because of Wheel Pros issues.

OEM sales are 43% lower than Q1 FY2022 due to stocking and new model release dates.

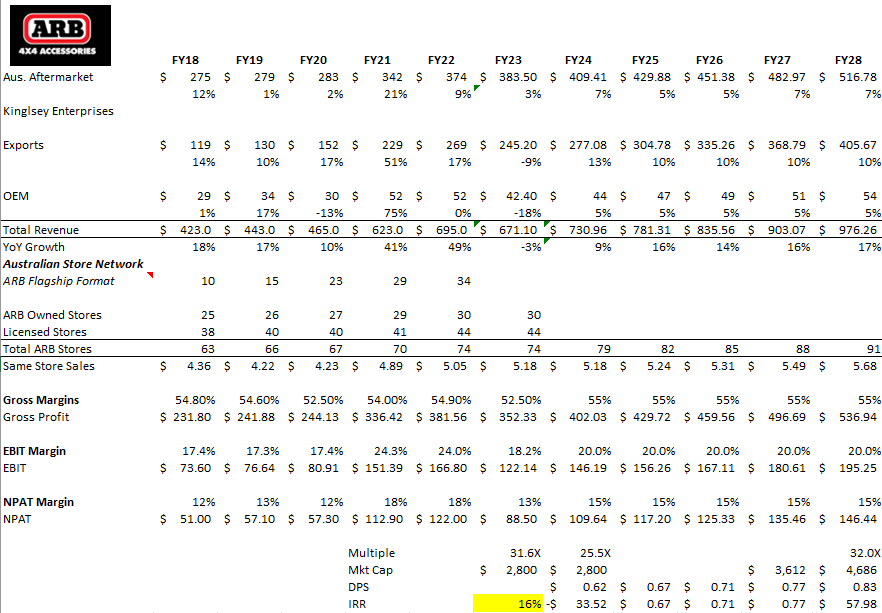

Valuation

My main assumptions in this valuation are:

Store Roll out of 5 new stores in FY24 as a catch up from FY23, normalised run rate of 3 per annum in Australia. In my view this network can continue to expand for many more years especially as new Products like the Earth Camper are added to the customer offering. Stores drive Aus. Aftermarket with ~$5.2M Sales per store.

Exports growth of 10% beyond FY24 as USA store roll out and D2C offering commences.

EBIT margins return to ~20% as Gross profits normalise post COVID abnormal freight and Input prices return to normal and are sold through.

DPS payout of 50%

Exit multiple of 32x FY28. The long term average forward earnings multiple for ARB has been 25x NPAT.