Summary

Fisher & Paykel Healthcare ‘F&P’ which trades as FPH.ASX and FPH.NZ is no white goods company, that was long since divested in 2002. The business that remains is a rapidly growing, dominant market share owner of medical respiratory humidifiers (i’ll unpack what this is in detail below). I estimate that F&P has over 80% market share in the core product line, this product line grows at Mid Single Digits (MSD), however, its two newest product families are growing at 15%-20% per annum with minimal competition.

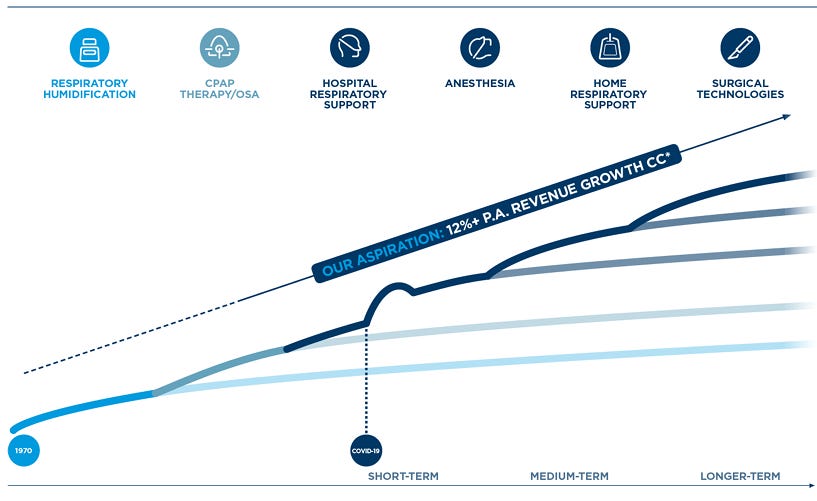

I forecast that F&P will grow revenue at a 13.5% CAGR over the coming 5 years (I feel its possible to look that far forward with this business due to its ~85% recurring revenue) and will expand operating margins (EBIT) back up to 30% within the next 5 years as a function of Gross Profits improving back to 65% due to post COVID normalisations and manufacturing efficiencies. These are aspirations that management have put out in their most recent FY23 Full Year results. If we assume F&P maintain a dominant market position with 85% annuity revenue at 30% Operating Margins I believe it will maintain a premium multiple of ~40x NPAT. You might think this is high however in my experience quality companies maintain premium valuations through time. If these assumptions hold true F&P can produce a 18% IRR from todays NZ market cap of $12.9B (Including dividends) - I will post my model down below to see the assumptions included.

History of F&P

There are two great books about Fisher & Paykel that delve into history and the foundations of the culture and people, if you feel the desire to go a bit deeper than my research they are:

Defying Gravity - The fisher and Paykel Story Keith Davies, Available to purchase online

Make a life and live it David O’Hare, Available by visiting F&P HQ

F&P was founded in 1934 in Auckland by Sir Woolf Fisher and Maurice Paykel to import a range of white goods. From 1934-1969 - F&P built engineering and manufacturing capacity to design and sell their own range of whitegoods products. This was a successful business and F&P built substantial manufacturing expertise and capability. Due to this reputation F&P were regularly presented with proposals from local engineers and universities, one such proposal was for a home dialysis machine, F&P were advised transplants were the way of the future!. however, a government electrical engineer Mr Alf Melville presented a proposal for a respirator humidifier for intensive and critical care wards. The first prototype was built from a glass preserving jar which is still sitting in the foyer of F&P head office in Auckland.

What is a Respiratory Humidifier

A respiratory humidifier is a critical device that connects to a ventilators output (outlined below) to convert cold, dry medical grade oxygen into warm, humidified air. A ventilator is a device that mechanically pushes air in and out of a patients lungs when the patient cant breathe for themselves. A ‘humidifier’ consists of a flow generator (that controls the volume, temperature and humidity of the air) and the breathing circuit and mask.

When you are placed on a ventilator a long plastic tube is inserted down your throat into your lung cavity, this bypasses your bodies natural humidifying process of the nose and mouth. Heat and moisture exchange is one the most important functions of the respiratory system. The nose contains a rich vascular system of thin walled veins and this network of veins is responsible for warming inhaled air to increase its humidity carrying capacity. As you inhale air down the respiratory tract it reaches 37degrees Celsius and 100% humidity. Deep down in the respiratory system are a range of mucosal cells that are responsible for trapping bugs and interfaces for humidity exchange. With these systems bypassed by a plastic tube delivering cold dry oxygen from a tank the lower respiratory system is put under enormous pressure. If a patient is ventilated for a long period of time significant medical complications emerge and risks to a vulnerable patient increase. There are over 90T research papers written in total studying the physiological effects of the humidification of air during mechanical ventilation.

In summary humidified air with ventilation is no longer questioned and is now standard of care. Achieving standard of care is a milestone that can only be achieved with the time taken to complete the volumes of research, studies and trials.

Ventilator Industry

The ventilator industry is not dominated by one major manufacturer it is spread across >10 providers. Each of the manufacturers have a unique device that has its own software, hardware interface with unique engineering and mechanical features. A humidifier is required to fit with each of these ventilator manufacturers that a hospital may have installed.

Getinge A medical technology public company listed in Stockholm, founded in 1904 with $4B AUD of revenue. Mechanical ventilator market share of 22%.

Hamilton Medical Sole ventilator manufacturer based in Switzerland, founded in 1983 with an estimated market share of 20% of the ventilator market.

Drager is a manufacturer of Medical and Saftey breathing equipment, roughly 50/50 split across both segments. Was founded in 1889 and headquartered in Germany. An estimated market share of 16% of the ventilator industry.

Mindray A Chinese medical device manufacturer founded in 1991. With close to $2B USD of revenue and an estimated 10% market share of ventilators worldwide.

Medtronic A USA based device manufacturer, founded in 1949 with a large diverse range of medical devices in its portfolio. Holds an estimated 5% market share of ventilators worldwide.

Lowenstein Medical A small German manufacturer of ventilators with an estimated 3% market share worldwide.

Vyaire Medical A US based medical device business that manufactures across a range of product lines. It holds an estimated market share of 3% of the ventilator industry.

GE Healthcare A large well known manufacturer based in the USA, it holds a 3% market share in the ventilator industry.

Phillips another well known medical brand, based in Netherlands. Also a large market share owner of the CPAP market. It holds a market share of 3% of the ventilator industry.

Other manufacturers makes up the balance of the industry at ~15%.

Humidifier Industry

The only competitors in the humidifier space are Hudson RCI, Vapotherm and Armstrong Medical. I have focused on their scale ($USD revenue), sustainability (profit) and clinical reputability (# of research citations) to determine their market position. as shown below Its clearly evident that F&P are truly dominant on all fronts and possibly have greater than 80% market share.

The other Respiratory Humidifier manufacturers that are cited in research are:

Hudson RCI, This was previously owned by Teleflex (NYSE:TFX), In May 2021 it was sold to Medline for $286M USD, it was producing $139M of revenue. It was said at the time of the divestiture in TFX earnings call transcripts that the “respiratory business was very low margin”. Teleflex gross margins were~50% and EBIT margins are ~15% at the time.

Vapotherm (NYSE:VAPO) is a pure respiratory business that sells humidifier and oxygen therapy products. It produces $66M USD of revenue and appears insolvent with a $100M loan and net operating losses per annum of ~$50M per annum.

Armstrong Medical is a respiratory support medical device company that manufactures the AquaVENT humidifier and a range of high flow devices. Armstrong was acquired by Eakin Healthcare Group in December 2020, the price was undisclosed but in filings it was announced that Armstrong was producing EBIT of 2.3M Euro on 14M Euro of revenue.

There are several other humidifier suppliers, some based in Asia that are sub scale small providers. F&P competitive advantage will be discussed further down.

Business overview

F&P split their business into two broad segments:

RAC - Respiratory and Acute Care. These are products that are used in the hospital setting and include the cornerstone MR850 Flow Generator and the new upgraded F&P 950 Flow Generator system. If you group these two products together they are referred to as ‘Respiratory Humidification’. These two systems are used for Invasive (Intubated) and non-Invasive (face mask) applications. The two ventilation systems are the original products that constitute bulk of the businesses reputability. It was from this original technology the fundamental capabilities of the business were built (I will put a pin in this for now and cover down below).

The Airvo 2 and Airvo 3 products these are used in the fast growing and under penetrated Nasal High Flow (NHF) applications. Patients are recommended NHF therapy in a range of applications including post operative recovery, COPD, Respiratory failure. There have been 111 controlled trials and multiple medical authority guidelines issued to support the clinical use of NHF. What’s even more impressive is that of the 34 published studies on NHF 33 were completed with F&P Optiflow Airvo products set to the F&P high standards of consistent flow volume >60L/Min and stable temperature of 37 degrees. Of over ~5400 research publications on NHF, 75% was in the past 5 years providing a strong tailwind for clinical adoption.

Anasthesia NHF product is not mentioned specifically as it utilises the High Flow units hardware however early clinical evidence has shown that by using NHF when intubating a patient an Anaesthetist has 10x more time to insert the tube down the throat of the patient (20mins vs 2mins). F&P don’t discuss how many patients are currently being treated here but the size is almost as big as the Hospital Respiratory support market (50M Patients) and F&P is growing rapidly in this sector.

HumiGard is a longer term 15yrs+ growth channel for F&P and is used for humidification of air in open surgery and laparoscopic surgery. In the surgery theatre the air is kept cold and dry for obvious reasons. If surgery can be conducted with humidified air it can improve recovery times and improve the patient safety during surgery. This is in the early stages of clinical adoption with only ~300 research publications completed, interest in this clinical area is accelerating.

The Hospital product group comprises 73% consumable sales and 27% new install base product sales or replacements. The consumables components include chambers that hold the water, Breathing circuits to deliver and heat the air (tubes), Masks and Nasal Canula. All of these components are single use must be replaced for the next patient.

OSA - Home Care / OSA these products are used in the home including the Sleep Style CPAP device. This product is used for Sleep Apnea which is a condition that results in a patients airways closing during sleep and resulting in continued sleep disruptions, this have been clinically accepted to lead to deteriorating health conditions. The mask is the key to compliance and compliance is the key to better health outcomes. The standards of air delivery are much lower in this segment. It is not as critical to ensure temperature and flow is precisely maintained as the body is still participating in normal respiration.

My AIRVO2 device is a lower spec more afforable version of the Hospital grade Airvo2/3. This product is used for patients requiring oxygen therapy at home or in longer term recovery facilities. Again because this produce delivers air in a non-invasive way incorporating the bodies natural respiratory system the consistency of flow and temperature can fluctuate.

The Homecare product group comprises 84% consumables revenue from the sale of Masks and breathing circuits.

To summarise the F&P portfolio the below table and chart outline the number of patients on treatment and size of the market combined with the growth rates of each segment. As you can see the Hospital Respiratory (NHF) and Anesthesia products are growing rapidly at ~20% per annum and in 3 years will make up the majority of the product portfolio. In my view this will upgrade the total revenue growth rate.

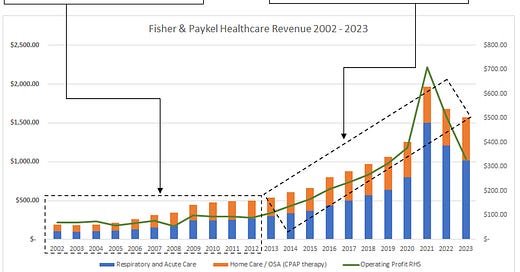

Historical Business Growth

As you can see below from 2002 - 2012 F&P earnings went sideways, in fact it earned the same pre-tax profit in 2012 that it did in 2002. During this time revenue was compounding at 9% while the business was continually investing in sales force expansion and R&D expansion.

During the 2002-2012 decade Gross margins were the key detractor from earnings growth with Gross Margins contracting from 69% to 53%. The business absorbed two new flow generator releases and a 6,100sqm manufacturing expansion, these go a way to explaining some of the gross margin inefficiencies.

From 2002 - 2012 the direct sales force was also expanded around the world, however, the business was still using Cardinal Health to distribute the hospital product range in the USA. F&P took responsibility for direct sales in the USA in 2015.

Fisher & Paykel Competitive Advantage

Achieving multibagger returns takes time, at a 26% CAGR a 10x takes 10years and a 100x takes 20years, these are huge growth rates but with decades of time. The interesting thing is that 80% of the return is achieved in the last 20% of time so the ability of a business to withstand competitors and be there for the last 4 years is critical, this ability to withstand competitors requires a strong competitive advantage.

The competitive dynamics of F&P’s business if I were to summarise them collectively:

Threat of Entry, If the barrier is high and/or the new entrant can expect sharp retaliation then the threat level is low. I consider the Barrier to be the main element for F&P and consider the threat to be low for the following reasons:

Economies of scale in almost every function of the F&P business there are scale economics crushing new entrant unit economics:

Manufacturing volume - I estimate F&P have 90% market share of hospital respirators & Ventilators along with the associated consumable equipment providing lower unit costs. This is exemplified by EBIT margins of biggest competitor being less than 1/3 of F&P

R&D - F&P are spending ~10% of revenue which is now over $170M per annum on the niche speciality of humidified air, a newcomer has a high bar to leap to compete with over 2000 patents worldwide.

Sales force density - F&P have a ~1,000 strong direct sales team educating practitioners, researchers and medical staff on installing and increasing the use of F&P Humidifier products. This service level and sales force profitability is difficult for a new entrant to compete with.

Product Differentiation F&Ps humidifiers are highly differentiated based on flow rates, temperature and saturation. Other providers cannot perform the same function.

Capital Requirements large financial investments required for potentially unrecoverable R&D and regulatory approvals. F&P achieved this through multibusiness subsidies in the late 70’s when the whitegoods business funded the significant operating losses incurred for decades while the first products were slowly commercialised.

Switching Costs Switching from an F&P flow generator involves employee retraining costs, new ancillary equipment, Cost and time of in house trials. These costs are major and also involve significant risk to the continuum of patient care. And given F&P are the undisputed leader in quality and reliability the switching benefit is minor/non-existent.

Low Bargaining Power of Buyers, generally the buyers bargaining power of F&P Hardware and Consumables is low characterised by:

No identifiable large volume buyers in F&P customer mix, also no heavy fixed cost which requires throughput as consumables insulate this.

relatively small cost to the Buyer (Medical devices only represent 7% of a total hospital budget)

Highly differentiated product to competitors, F&P provide higher flow rates at reliable temperature consistency resulting in better patient outcomes and fewer complications. Abnormal peaks in flow and/or temperature can cause permanent damage to your respiratory system.

Large switching costs to buyers, requires re-training, re-tooling, and significant risk to patient continuum of care for immaterial switching benefit.

No buyer integration capability, buyers are unable to in-house the development of their own humidifiers.

Important to quality of buyers service, if a buyer doesn’t have a F&P humidifier they are delaying recovery times which increase patient care costs and also exposing patients to more risks.

Low Bargaining Power of Suppliers, Generally suppliers to F&P are non-critical due to the extent of F&P’s vertical integration.

Of the high value suppliers I spoke with F&P are critical customers to them and treat them well, but are also very strict with non-compete clauses and pricing controls.

Multiple suppliers available for most inputs, mainly raw materials.

Very few critical components supplied to F&P as the business is vertically integrated right through to printed circuit boards.

majority of supplier groups products are broadly undifferentiated with little switching costs between suppliers

Labour is generally unorganised in that it is non-unionised and can expand with demand with available capable employees.

Business Models identified

Gold Standard/Assurance benefit. Quality - Majority of the research for the benefits of NHF therapy are completed at >60L/Min flow rates at 37degrees celsius that only F&P can achieve with intensive care consistency. This standard is a barrier to clinician adoption of alternatives and this standard is now written by the medical authorities. Reliability - having been focused on respiratory humidification for 4+ decades a large amount of trust is built with the medical community this can only be replicated with time.

Install base with attached recurring consumables stream. The installation of the flow generator is followed by a continual repurchase pattern of the accessories which require replacement after each use. The second layer of competitive advantage wrapped around this is the network of trained users of F&P product, this network can provide troubleshooting and support on site as many clinicians have used F&P breathing circuits and humidifiers their entire career.

Management and Culture

Management are Long Tenured with an average tenure of 19.5yrs at the senior executive level. The original founders of F&P are Sir Woolf Fisher and Maurice Paykel, Although the Healthcare business was really founded by David O’Hare who was the first General Manager of the Healthcare division, he took Dr Matt Spence’s preserving jar prototype humidifier, made it into a product and travelled around the world educating clinicians and selling it. He worked for F&P from 1960 to 1990 and passed away in 2006.

During this time David trained an understudy Michael Daniell who was CEO until 2016 and spent 37years with the company. During the Daniell era, Lewis Gradon was trained and now runs the business. You can see below the long tenure of the senior staff.

Culture

Many of the senior leaders in the business have a personal story about their journey to F&P, I met several ‘missionaries’ with stories of family members and friends being saved by their products. Many are attracted by the passion to do something meaningful. As we know from Jeff Bezos Culture statement at Amazon:

"To hire and retain great people you must first given them a great mission”

He also says that

“ A culture is created slowly over time by the people and by events – by the stories of past success and failure that become a deep part of the company lore. If it’s a distinctive culture, it will fit certain people like a custom-made glove. The reason cultures are so stable over time is because people self-select”

I heard a number of stories of managers that left high paying jobs in law and finance to join F&P. If I were to categories the handful of people I met as either ‘mercenaries’ (in it for the money) or ‘missionaries’ (true passion for the customer) I would say they were the latter.

The feeling at F&P is a standout feature, if you ever visit the 70 acre Auckland site. It is a truly world class campus with neat gardens, manicured lawns and open space, it has a Google Campus feel to it. They provide lunch for the team at a heavily subsidised rate (raw material cost only, my chicken salad cost $4.50), this lunch is provided in a large cafeteria with large round tables that everyone shares together. The site hallways are long and wide with lots of natural light, this is to encourage the team to frequently walk past each other and stop to talk. The office layouts are all open plan, no one has an ‘office’ even the CEO is sitting in the same wrap around desk and chair.

The engineering office block runs along side the manufacturing line separated only by a floor to ceiling glass panel, Manufacturing staff can look in and see the office staff and vice versa, this is to eliminate the “us vs them” mentality, it also promotes accountability. When engineers are implementing improvements or fixing breakdowns a red light flashes on the production line for everyone to see. The manufacturing facility floor is heavily taped exemplifying the Kaizen mentality, all the KPIs are tracked on whiteboards and measured in red or green almost like a Danaher Business System PD Matrix (ex DHR CEO Lawrence Culp said the “key item from the DBS is the PD tool”, this works by tracking output measures against key targets to deliver policy objectives like ROIC or Profitability) even the rubbish bin had its spot at F&P, “we use tape not paint because improvement is never permanent, it can always be increased”.

The engineering buildings are separated into their products groups, and each building has its own clinical ward that has been built inhouse to replicate an ICU, engineers are expected to spend time in these wards while experimenting on designs or improvements, this promotes the focus on the practicality for the patient and the clinician.

The foundational culture embedded in senior leaders in the business is one of conservatism, they don’t believe they should hold material debt even though they could and because of their market dominance they believe they have a duty to hold idle manufacturing capacity to respond to world emergencies when needed. Which they have had to do twice for SARS and COVID. The business also has the heritage as a post depression company that endured tough times in New Zealand, this has set the tone for a conservatism within the business.

F&P are unlikely to undertake M&A as they see it outside their core competence, they are focused on building more products and treating more patients.

In summary the culture really struck me as a high performing organisation that will continue to attract and retain high quality long term orientated people.

Incentives

The incentive program is broken up in to Annual (DAVR) and Long term (LTVR), there are over 700 team members on this program, it is not reserved just for the senior leaders.

The DAVR is paid based on 45% weighting to an operating profit target, 25% Revenue target, 10% Pre tax cash flow target and 20% non-financial including quality, safety, long term strategy etc.

The LTVR is paid as a mix of options and performance rights, the options vest if the companies share price has exceeded the price at the 3rd year compounded at the Cost of capital. The Rights vest if the TSR exceeds the Dow Jones Medical product index by 10%.

The company also has a profit sharing program, whereby 2.5% of NPAT is shares across the business equally it is based on 20hours at your hourly rate. There are no hurdles to achieve this other than being employed for longer than a year.

Valuation

This is always the hardest part of an investment decision in a high quality company in my view. My model is below, assumptions are outlined.

The key assumptions are:

Revenue CAGR of 13.5% per management guidance of a 2x over 5.5yrs.

Gross Profit margins to return to 65% as post COVID abnormal costs and inefficiencies start to normalise

Operating margins (EBIT) to return to 30% as gross profits improve.

DPS pay out at 45% and SOI issue growing at 80bps due to long term incentive plans.

The ending NPAT margins of 23% are in line with larger Medical device companies such as Cochlear, ResMed and install base business models like Danaher and Thermofisher that also have ~80% recurring revenue consumables.

The exit multiple of 40x NPAT might seem crazy to some people, however, companies that have high levels of consistent, reliable earnings growth and have a deep competitive advantage that has been tested and proven over a long period of time attract premium valuations. If you want to dial it down, a 25x NPAT exit multiple produces an 8% IRR. below is a comparison of some domestic medical device companies (COH & RMD) and some offshore recurring revenue business models (DHR, TMO).

It would be great to hear from any investors who have some insight into F&P as a supplier, customer, user, employee or investor. If you feel i’ve missed anything in my analysis please reach out!